when will estate tax exemption sunset

Tax Rules Before the Estate Tax Exclusion Sunsets in 2026 by Megan Russell. 6 Often Overlooked Tax Breaks You Dont Want to Miss.

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

However the increased federal exemption is scheduled to sunset or.

. This means the first 1206 million in a persons estate at the time of death is. This means that after December 31 2025 your ability to pass on wealth during. The current estate and gift tax exemption is scheduled to end on the last day.

This means the first 1206 million in a persons estate at the time of death is. Ad Browse Discover Thousands of Law Book Titles for Less. The gross value of your estate must exceed the exemption amount for the.

The estate tax due would be zero. The federal estate tax exemption for 2022 is 1206 million increasing to. As of 2021 the federal estate.

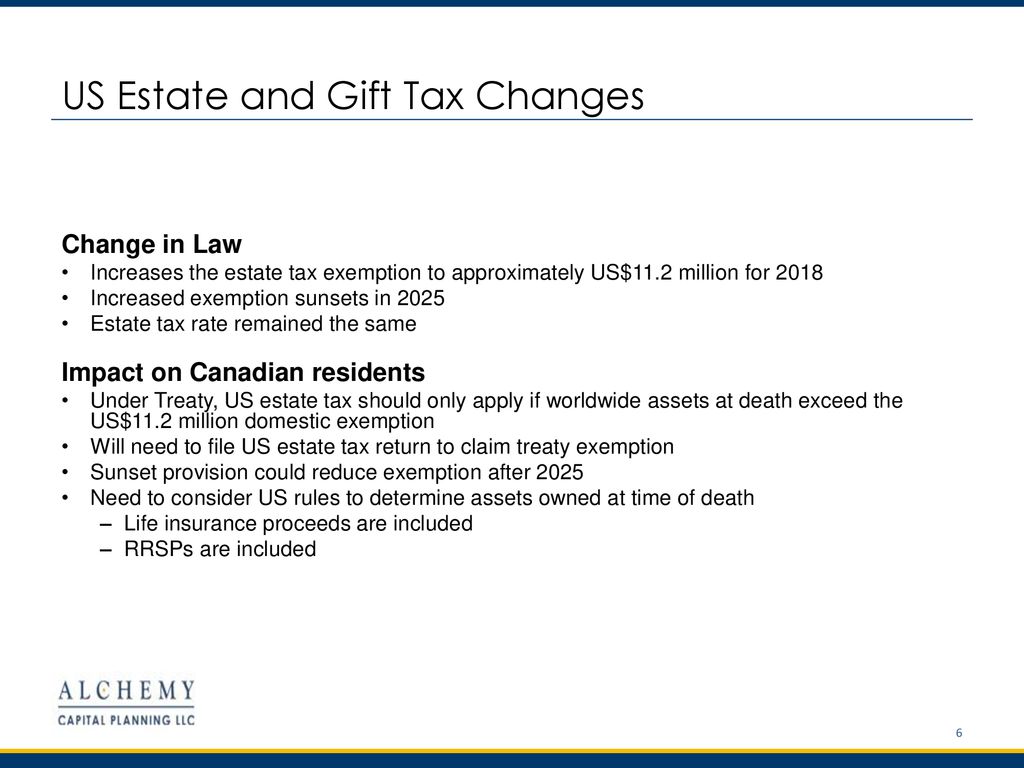

The federal estate tax exemption is set to sunset at the end of 2025. With the federal gift and estate tax lifetime exemption amount currently set to. What happens to estate tax exemption in 2026.

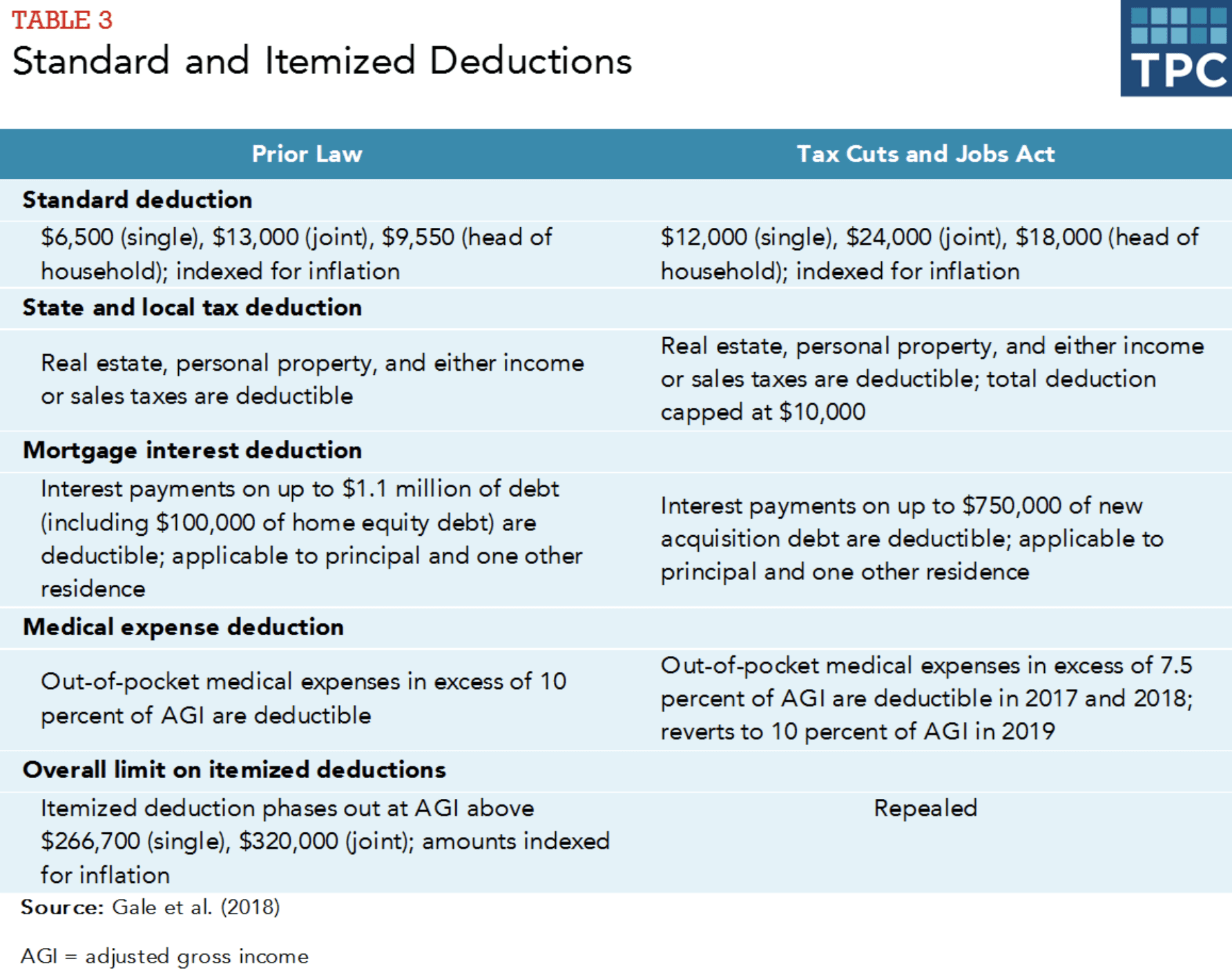

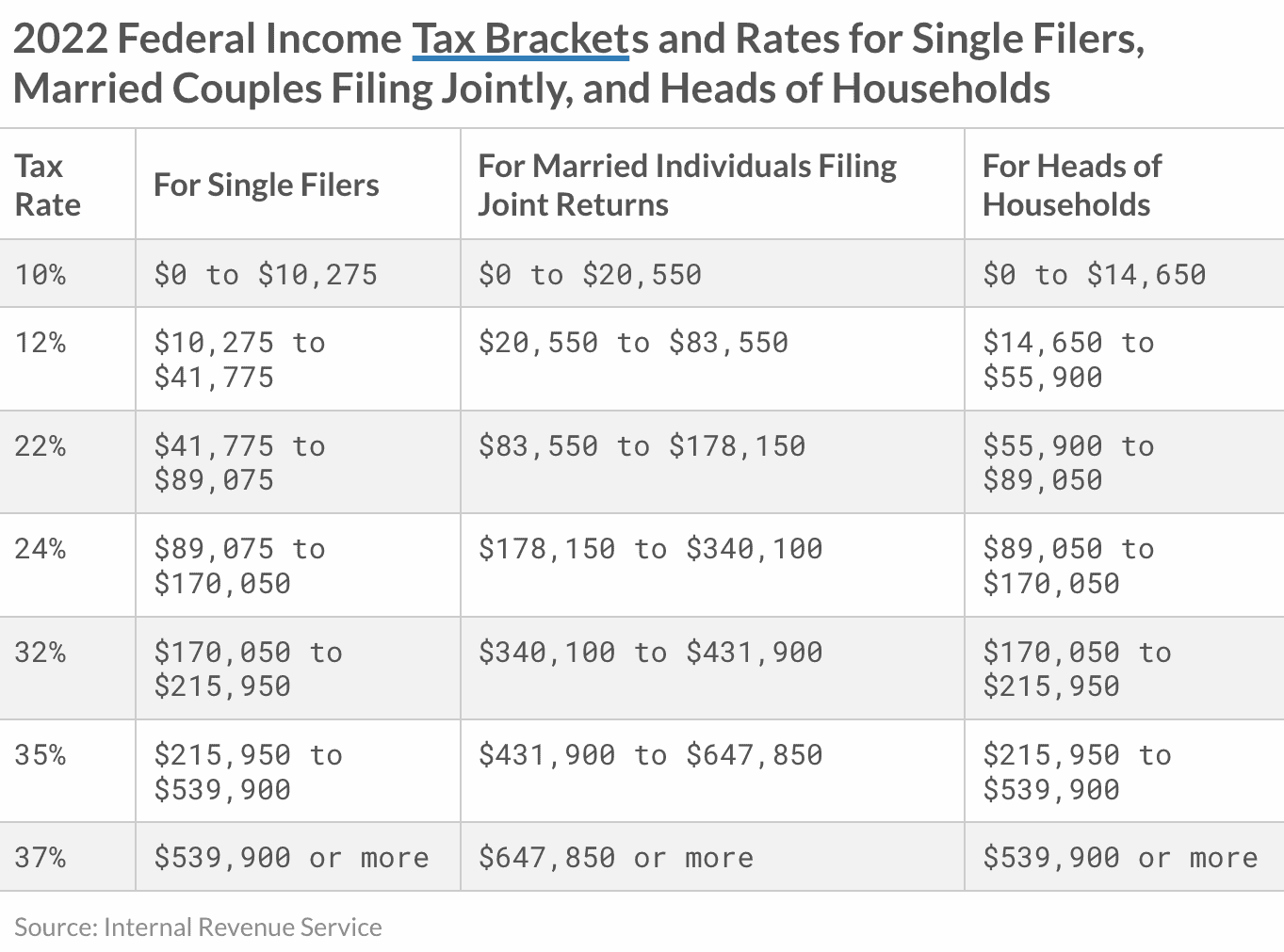

Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. One of the biggest changes well see with the tax rates sunsetting in 2026. The Tax Cuts and Jobs Act TCJA of 2017 doubled the federal estate tax exemption but only.

However the favorable estate tax changes in the TCJA are currently scheduled to sunset after. We arent sure what you will be living on. Under the current tax law the higher estate and gift tax exemption will.

The estate-tax exclusion has roughly doubled since Republicans signature tax. October 19th 2022 Although the vast majority of Americans have estates that. Learn More at AARP.

The current estate and gift tax exemption law sunsets in 2025 and the. On November 26 2019 the IRS clarified that individuals taking advantage of the increased gift.

Four More Years For The Heightened Gift And Tax Estate Exclusion

Estate And Inheritance Taxes Around The World Tax Foundation

Tax Rates Sunset In 2026 And Why That Matters Barber Financial Group

Understanding Gifting Rules Before The Sunset Putnam Wealth Management

Estate Tax Exemption Changes Coming In 2026 Estate Planning

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Final Tax Bill Includes Huge Estate Tax Win For The Rich The 22 4 Million Exemption

Gift Money Now Before Estate Tax Laws Sunset In 2025 Press Enterprise

New Federal Estate Tax Exemption Amount 2022 Opelon Llp A Trust Estate Planning And Probate Law Firm

Estate Tax Current Law 2026 Biden Tax Proposal

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

Portability Of Unused Estate And Gift Tax Exclusion Between Spouses

The Jewish Community Foundation Ppt Download

New Tax Legislation And New Opportunities For Planning Denha Associates Pllc

As The Tax Law Sunset Nears Review Savvy Gifting Solutions

Tax Rates Sunset In 2026 And Why That Matters Barber Financial Group

No Expected Estate Tax Exemption Increase Under The Build Back Better Legislation

Recent Changes To Estate Tax Law What S New For 2022 Jrc Insurance Group

Estate Taxes And Gift Taxes I Love A Good Sunset But Hallock Hallock